taxing unrealized gains 401k

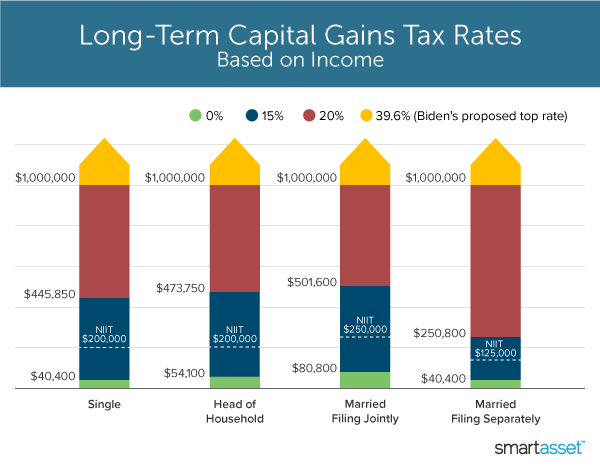

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. The government would love to get 25 percent of your 401ks annual rise and our nations massive annual deficits and cumulative debt means it will need that money sooner.

Biden Proposes New Minimum Tax On Billionaires Unrealized Gains Fox Business

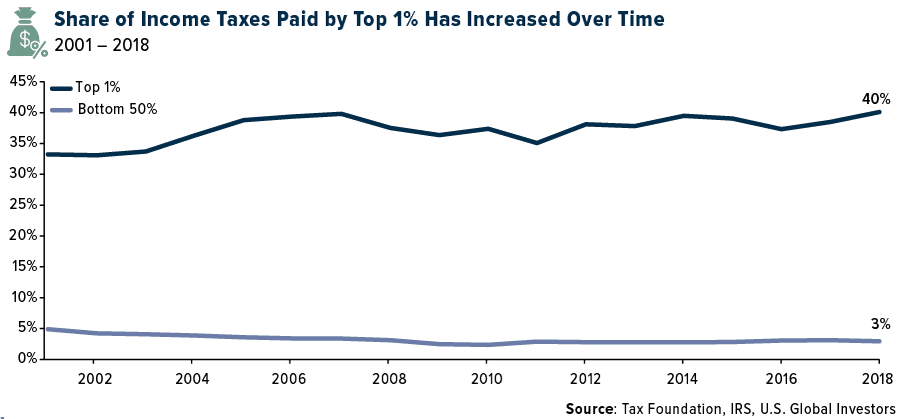

To increase their effective tax rate.

. Is the IRS going to allow 100 of unrealized capital losses to be written off each year since it will be taxing unrealized gains Scott Salaske founder and CEO of RIA firm First. As they explain it The wealthy pay low income tax rates year after year for two primary reasons. If you hold an asset for less than one year and sell for a capital gain the.

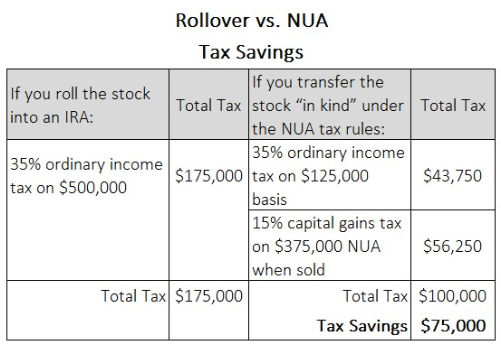

Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark Zuckerbergs. Simply put taxing unrealized gains cuts deeply against Americans sense of fairness and common sense. Taxpayers with employer stock in their retirement plan account should be aware of a potential tax saving strategy the net unrealized appreciation NUA election allowed under.

For example if you were ahead of the curve and bought bitcoin for 100 and. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Buy Sell and Trade your Firearms and Gear.

The Tax has Failed and Been Repealed in Foreign Countries. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. While fairly basic the QOZ program generates many questions one of which is if gains from a 401 k retirement fund can be rolled over into a QOF for the tax-deferral benefits.

Gains that are on paper only are called unrealized gains For example if you bought a share for 10 and its now worth 12 you have an unrealized gain. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Unrealized gains are not taxed until you sell the investment.

Firearm Discussion and Resources from AR-15 AK-47 Handguns and more. An unrealized gain is an increase in your investments value that you have not captured by selling the investment. First much of their income is taxed at preferred rates.

Stock Market At Risk Along With 401KS And Other Retirement Plans Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the. Under the proposed Billionaire.

Net Unrealized Appreciation Nua Bogart Wealth

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

The Details Of Hillary Clinton S Capital Gains Tax Proposal Tax Foundation

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Exxon 401k Savings Plan Net Unrealized Appreciation

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

The Unintended Consequences Of Taxing Unrealized Capital Gains

Net Unrealized Appreciation The Untold Story Baltimore Washington Financial Advisors

A 401 K Tax Break That S Often No Break

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

Nua Choice A Tax Strategy To Consider If You Own Company Stock Morris D Angelo

An Overview Of Capital Gains Taxes Tax Foundation

Net Unrealized Appreciation Nua Tax Strategies In Retirement

Mega Backdoor Roth Bogart Wealth

The Unintended Consequences Of Taxing Unrealized Capital Gains Usgi

Carve Out Your 401 K Company Stock For Favorable Nua Tax Treatment Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You